What method is used to go short? ETF options?

$FXI

When I first started holding the CSI 2000 Enhanced, this thing was only about 30 million in size, a small transparent entity about to hold a liquidation meeting. After a few months it broke the hundred‑million mark, bustling like a vegetable market. Unfortunately, the former fund manager has already left, handing a bunch of funds to his colleague, and we can’t see the current situation.

That being said, is the micro‑cap market still rising endlessly? The valuation and such look a bit risky.

According to Yu Li, A‑share dividends mainly stem from an increase of one trillion yuan in insurance funds over the past four quarters, but Hong Kong stock dividends have risen even more—who is buying? The A/H price ratio of 124 is close to a historic low.

I thought the tariff shock had ended, so I took some money out of Germany to use. Last night Germany staged a “天地板”, what is that? How’s

It has risen another 30% from here to now.

Actually, I’m completely unfamiliar with this aspect, so I haven’t dared to get on board.

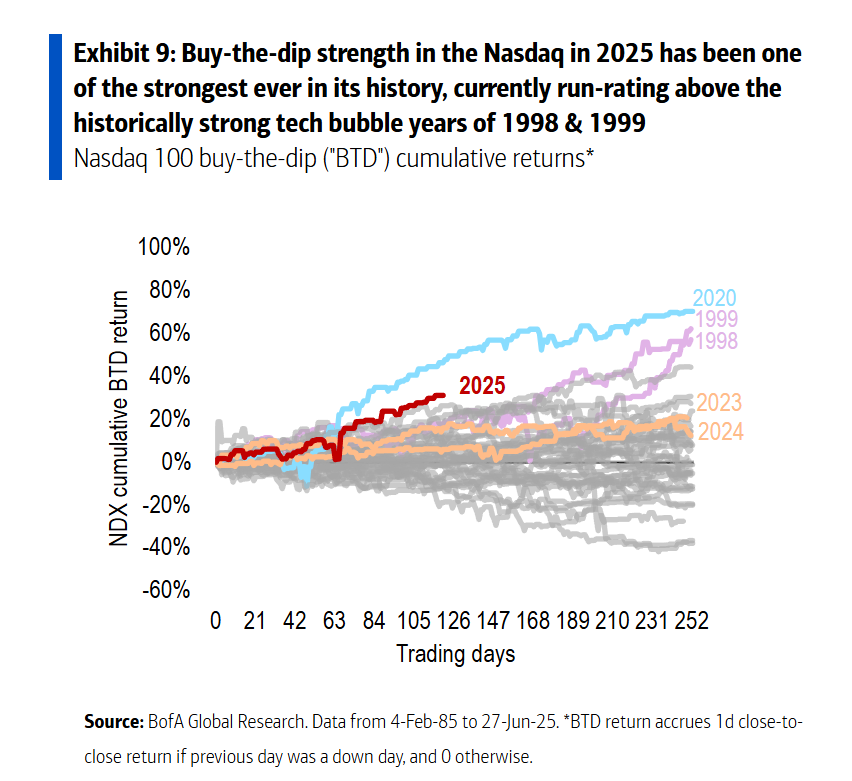

It will continue to rise in the second half of the year.

In the short term, there will be a pullback.

Innovative drugs target new productive forces, not traditional medicine.

First wait for the callback, now the position is maxed out and there’s no money.

I expect a callback of around 10 points.

Runben is too weak compared to Rainbow; I hope this week it can bring me some profit.

The trend of JiuZhiTang is also terrible; after entering I kept eating noodles continuously, and it’ll crash tomorrow.

The pullback in innovative drugs is good; I’ll rebuild my position tomorrow.

iFlytek, please don’t disappoint me.

Science and Technology Innovation Chip ETF entered at -1 on Thursday afternoon, then surged 11 points on Friday—awesome.

r Teacher Yichuan, have you considered US stocks/Hong Kong stocks?

I’ve considered it, but there’s no way to invest… As a freshman I already want to go all‑in on NV.

Fortunately, at least for the next year, A‑shares won’t be too bad.

Can’t understand it anymore. On Friday at noon I sold the Sci‑Tech Innovation 50 (科创 50).

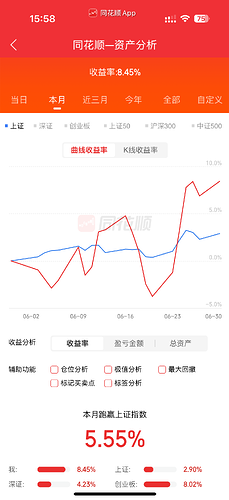

From the beginning of the year until now I’ve held the Sci‑

Definitely hold it, this round of semiconductor chips + innovative drugs—I’m now fully invested in these two, and I also have a bit of flexible capital allocated to Angel Yeast and Shunwei.

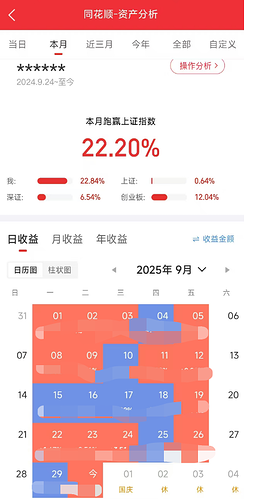

Stock guru, take a look at the portfolio; I’m planning to enter after the National Day holiday, copying yours.

Let’s do a Hong Kong innovative drug ETF this month.